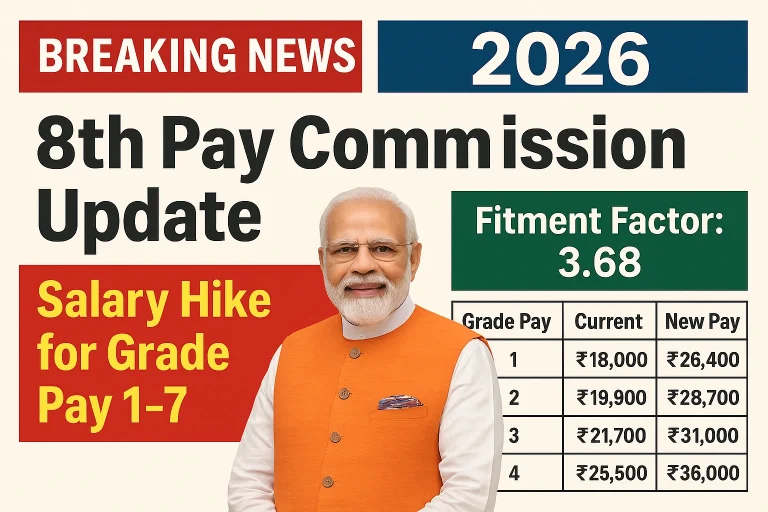

8th Pay Commission Latest Update 2026: Salary Hike, Fitment Factor (3.68), Pay Matrix & Calculator

Latest Update (November, 2025):

As per recent reports, the 8th Pay Commission is expected to take effect from January 1, 2026. The proposed fitment factor is 3.68, with a likely salary hike of 30–35% for central government employees.

Table of Contents

8th Pay Commission Grade Pay-wise Salary Increase (2026)

| Grade Pay Level | Current Basic (7th CPC) | Expected Basic (8th CPC) | Approx. Hike | Employees Covered |

|---|---|---|---|---|

| Level 1 | ₹18,000 | ₹26,400 | ₹8,400 | Clerks, MTS |

| Level 2 | ₹19,900 | ₹28,700 | ₹8,800 | Assistants |

| Level 3 | ₹21,700 | ₹31,000 | ₹9,300 | Technicians |

| Level 4 | ₹25,500 | ₹36,000 | ₹10,500 | Senior Clerks |

| Level 5 | ₹29,200 | ₹41,000 | ₹11,800 | Supervisors |

| Level 6 | ₹35,400 | ₹50,000 | ₹14,600 | Section Officers |

| Level 7 | ₹44,900 | ₹63,000 | ₹18,100 | Superintendents |

7th CPC vs 8th CPC Comparison Table (2026 Update)

| Parameter | 7th CPC | 8th CPC (Expected) |

|---|---|---|

| Implementation Year | 2016 | 2026 |

| Fitment Factor | 2.57 | 3.68 |

| Minimum Pay | ₹18,000 | ₹26,400 |

| Average Hike | 14% | 30–35% |

| DA Reset | 0% | 0% initially |

| Review Period | 10 Years | 10 Years |

This guide explains expected salary changes, fitment factor possibilities, DA reset logic, and a practical way to estimate your pay using the calculator above. It is an informational overview based on public discussions and historical patterns; always verify with official notifications.

Key Points About the 8th Pay Commission at a Glance

Fitment factor widely discussed in media ranges from ~1.92 to 3.15 in speculation; many estimates model 2.86 to illustrate possibilities.

DA reset generally starts near 0% at the beginning of a new pay cycle and then builds with AICPI-based revisions.

Historical cycles suggest implementation around 2026 is plausible if announcements proceed; however, actual timelines depend on official decisions.

Use the top calculator to simulate your projected 8th CPC basic, DA, HRA, TA, and gross for different scenarios.

8th Pay Commission Fitment Factor 3.68: Full Explanation

The fitment factor is a multiplier applied to your current 7th CPC basic pay to derive an indicative 8th CPC basic. Example:

If your current basic is ₹56,100 and you test fitment 2.86, then new basic ≈ ₹1,60,446.

HRA (city-wise), TA and DA (on new basic) are added to reach gross pay.

Pro tip: Run multiple “what-if” simulations (e.g., 2.57 vs 2.86 vs 3.00) to plan EMIs and savings with a conservative margin.

8th Pay Commission DA Reset Cycle (2026 Onwards)

When a new pay cycle starts, DA typically resets (near 0%). It then rebuilds every 6 months based on the AICPI. This means your take-home grows over time, even if basic stays constant.

8th Pay Commission HRA and TA in the New Cycle

HRA: Often linked to city class (X 27%, Y 18%, Z 9% assumed for illustration). A higher basic in 8th CPC implies higher HRA amounts even at the same percentage.

TA: Usually slab-based; DA applies on TA as well. In the calculator we’ve modeled ₹1350 for higher-TPTA and ₹900 for other cities as indicative figures.

7th vs 8th Pay Commission Comparison Table

| Example Level | Current Basic (7th) | Fitment (2.86) New Basic | X City HRA 27% | Gross w/ DA 0% + TA (1350) |

|---|---|---|---|---|

| Level 1 | ₹18,000 | ₹51,480 | ₹13,900 | ₹66,730 |

| Level 5 | ₹35,400 | ₹1,01,244 | ₹27,336 | ₹1,29,930 |

| Level 7 | ₹44,900 | ₹1,28,414 | ₹34,671 | ₹1,64,435 |

| Level 10 | ₹56,100 | ₹1,60,446 | ₹43,321 | ₹2,05,117 |

Figures are rounded and for scenario-planning only.

8th Pay Commission Timeline and What to Watch

Historically, commissions take time to constitute and report, and implementation often follows a year boundary.

A commonly discussed effective date for arrears in public chatter is 1 January 2026, but the actual notification is decisive.

Keep an eye on: Finance Ministry communications, Department of Expenditure pages, and Lok Sabha starred/unstarred questions.

How to Use the 8th Pay Commission Calculator Effectively

Enter current basic (7th CPC).

Choose your pay level (for your own reference in the result).

Test fitment scenarios (2.57 / 2.86 / 3.00…).

Select HRA by city class and TA slab.

If you want a possible future state, add DA% (e.g., 10 or 12) to see how take-home might evolve after a few cycles.

8th Pay Commission Salary Examples (Level 1 to 10)

Example 1 Level 1 employee in X city

Current Basic: ₹18,000 → Fitment 2.86 → New Basic ≈ ₹51,480

HRA (27%): ≈ ₹13,900; TA (₹1350, DA 0%)

Gross ≈ ₹66,730 (without DA initially)

Example 2 Level 9 employee in X city

Current Basic: ₹53,100 → Fitment 2.86 → New Basic ≈ ₹1,51,866

HRA (27%): ≈ ₹41,004; TA (₹1350)

With DA at 0% initially, Gross ≈ ₹1,94,220 (approx.)

Re-run the same examples with DA 10% in the calculator to visualize growth a few revisions after the cycle begins.

8th Pay Commission Pension Implications in Simple Terms

Pensions often anchor to a fraction (e.g., 50%) of the last drawn basic pay. If the 8th CPC basic increases, pension calculations rise accordingly. DA/HRA frameworks for pensioners differ from in-service employees; always refer to official orders specific to pensioners (including family pension rules).

8th Pay Commission Allowances Beyond HRA and TA

Special duty allowances, risk/hardship, NPA (where applicable), and other ministry/department-specific allowances may see re-alignment in a new cycle. Expect rationalization and rounding norms similar to past exercises. Until official orders are published, treat any rates as indicative only.

8th Pay Commission Salary Chart PDF

YouTube Video Embed for 8th Pay Commission Calculator Guide

What is the fitment factor in the 8th Pay Commission?

The fitment factor is a multiplier applied to your current 7th CPC basic to estimate the 8th CPC basic. Common illustrative factors range from around 1.92 to 3.15, with 2.86 often used.

When can we expect the 8th Pay Commission to be implemented?

Observers generally anticipate implementation around 2026 if processes move ahead, though official notifications will confirm the exact date.

How will my salary change after the 8th Pay Commission?

Salary increase depends on your fitment factor, revised HRA, TA, and allowances. Use the calculator for scenarios like 2.57, 2.86, or 3.00 to see potential increases.

Does DA start from zero in the new pay cycle?

Yes. DA typically resets near 0% at the start of a new pay cycle and increases every six months based on AICPI.

Which HRA rates should I use for estimation?

Illustrative HRA rates are X 27%, Y 18%, and Z 9%. Confirm official rates once the government announces them.

Will my pension amount increase after the 8th Pay Commission?

Pensions linked to last drawn basic generally increase when the 8th CPC basic is revised. Official pension orders will provide exact figures.

Is the 8th Pay Commission salary calculator official?

No. It is an informational tool for planning and scenario estimation, not an official government calculator.

Will Travel Allowance (TA) change in the 8th Pay Commission?

TA slabs may be revised, and DA is applied on TA. Calculator examples show ₹1,350 for higher-TPTA cities and ₹900 for others as indicative.

Are other allowances expected to change?

Several allowances might be revised or rationalized. Final details will be announced in official communications.

Will arrears be paid after 8th Pay Commission implementation?

If the effective date is before implementation, arrears may be applicable as per final government orders.

Does city reclassification affect HRA rates?

If your posting city’s classification changes, HRA rates may adjust accordingly according to official rules.

How should I select my pay level in the calculator?

Refer to your appointment or pay matrix documents. The calculator’s quick search list provides indicative mapping only.

Will the 8th Pay Commission revise pay matrix levels?

The pay matrix system may continue with revised values. Official pay matrix tables will confirm final levels.

How soon will DA increase after reset?

DA revisions are usually done twice a year based on AICPI trends after the initial reset.

Are state government employees included in the 8th Pay Commission?

State adoption varies. Some states may implement central recommendations, while others may adapt or defer them.

How should I plan loans or EMIs before official notification?

Be conservative. Run multiple scenarios with the calculator and avoid overcommitting before final orders.

How can I estimate my salary for a specific pay level like ₹50,000?

Use the 8th Pay Commission calculator to input your current basic and pay level. The calculator will show estimated new basic, HRA, TA, and gross salary.

What is the minimum salary expected under the 8th CPC?

Illustrative Level 1 examples show minimum basic around ₹18,000 (before allowances). Exact figures will depend on the notified fitment factor.

How can I calculate my salary if I join in 2025?

Enter your current basic and pay level in the calculator. Test different fitment factors to estimate possible salary for 2025 or later.

How much DA hike is expected in July 2025?

Additional FAQs & Latest Updates on 8th Pay Commission

What is the latest news on the 8th Pay Commission?

As of 2025, official notifications are awaited. Many reports suggest the 8th Pay Commission may be implemented around 2026. Keep an eye on Finance Ministry announcements and Department of Expenditure updates.

Has there been any delay in the 8th Pay Commission?

Historically, pay commissions take time to constitute and finalize. The 8th Pay Commission was expected after the 7th CPC cycle, so minor delays are possible. The final implementation date depends on official notification.

What is the expected salary structure under the 8th Pay Commission?

The 8th CPC salary structure will include revised basic pay, HRA, TA, and DA. Illustrative PDFs and the online calculator can help estimate new salary for each pay level.

How much salary hike can government employees expect under the 8th Pay Commission?

Salary hike depends on fitment factor, revised allowances, HRA, and TA. Use the calculator to test scenarios (e.g., 2.57, 2.86, 3.00) for different pay levels.

Which employees are covered under the 8th Pay Commission in India?

Central government employees are automatically included. State government employees may adopt or adapt recommendations as per state policies.

8th Pay Commission Salary Calculator

This tool estimates basic pay under possible 8th CPC scenarios. It is informational and not an official calculator.

| Designation (Example) | Typical Level |

|---|---|

| Multi-Tasking Staff (MTS) | Level 1 |

| Postal Assistant | Level 4 |

| Accountant | Level 5–6 |

| Assistant Section Officer (ASO) | Level 7 |

| Section Officer (SO) | Level 8 |

| AAO (Audit/Accounts) | Level 8 |

| Assistant Engineer | Level 7–8 |

| Junior Engineer | Level 6 |

| Inspector (Income Tax/CGST) | Level 7 |

| Superintendent (CGST/Customs) | Level 8 |

| Assistant Professor (Entry) | Level 10 |

| Deputy Secretary | Level 12 |

| Director | Level 13 |

| Joint Secretary | Level 14 |

| Additional Secretary | Level 15 |

| Secretary | Level 17–18 |

Titles are indicative only. Check your appointment order/office circulars.

Manish is the content curator at OnlineChallanChecker.com, a trusted platform for checking challan status, payment updates, and traffic fine information across India. With over 5 years of experience in digital content creation and online service platforms, Admin is committed to delivering accurate, easy-to-understand guides that help users manage their challans effortlessly.